Chapter 3. – The Legal & Financial Aspects Affecting Children

*The legal component of the parenting course shall provide general Illinois family law principles. The presentation of this material is not intended to constitute legal advice. Parents should consult with a licensed attorney for answers to specific legal questions.

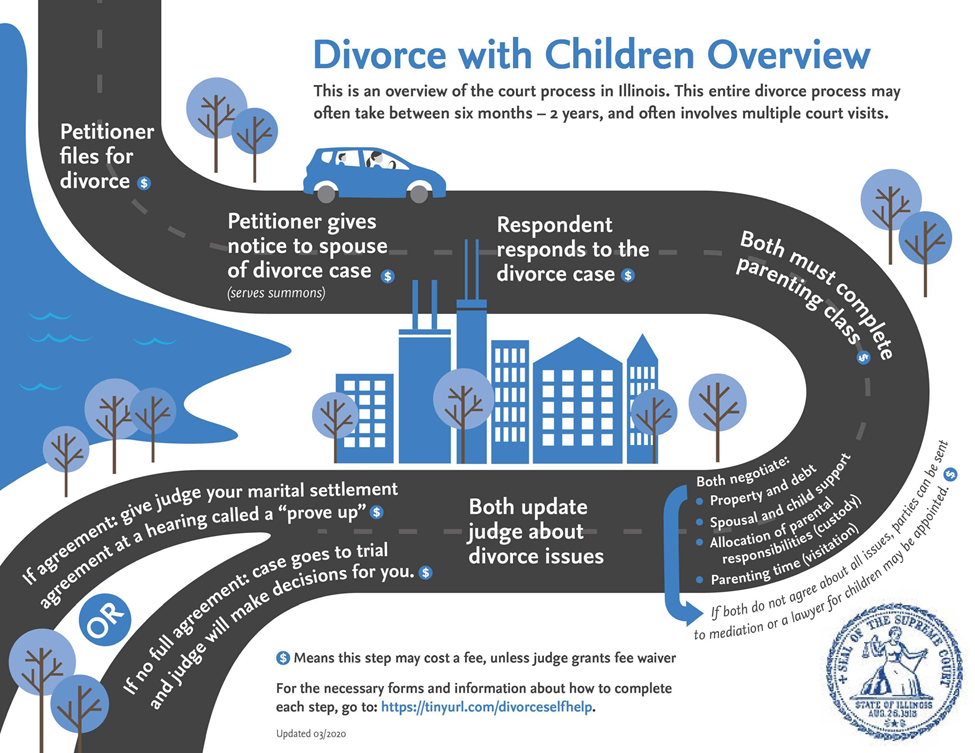

Understanding Court Procedures and Financial Responsibilities

One or both parents retaining an attorney or family mediator usually begins the legal process. Some couples inform their attorney from the start that they want a fair and equal settlement and to minimize conflict. This approach is recommended. To accomplish this, find an attorney accustomed to working this way, one who helps mediate differences and works toward collaboration and compromise. This will be in everyone’s best interest. A good way to choose an attorney is by getting a referral from a trusted friend or colleague. You will probably want to interview several attorneys, making sure you feel comfortable with their approach. Do not feel bullied into retaining an attorney not to your liking. Many attorneys will do an initial consultation for free, so you can decide if they will represent you effectively given the specifics of your situation.

Parents proceeding with the of either a dissolution of marriage or paternity case, requires that they begin dealing with some potentially challenging issues. These include financial support, visitation, and dividing up assets. In many instances, parents settle these issues on their own or with their attorneys’ assistance outside of court. It is estimated that approximately 96% of divorce cases are settled without a trial. Family-court judges prefer that parents settle their issues before reaching the courtroom, reserving formal trials as a last resort.

Filing, Required Documents

The Domestic Relations Division hears dissolution of marriage (divorce), dissolution of civil union, legal separation, parentage, child support, parenting time and decision-making (formerly custody), division of financial assets and property, maintenance (formerly alimony), and non-parent visitation cases.

Pre-Judgment Cases – All pre-judgment Domestic Relations cases shall be commenced by filing with the Clerk of the Circuit Court of Cook County a petition or other pleading conforming to Illinois statutes and court rules, accompanied by the following:

- A Domestic Relations Cover Sheet;

- A Certificate of Dissolution or Invalidity of Marriage as required by 750 ILCS 5/707 in cases involving dissolution or invalidity of marriage; and

- The applicable filing fee as published by the Clerk of the Circuit Court.

Post-Judgment Cases – All post-judgment Domestic Relations cases shall be commenced by filing with the Clerk of the Circuit Court of Cook County a petition, motion or other pleading conforming to Illinois statutes and court rules and accompanied by the applicable filing fee, if any, as published by the Clerk of the Circuit Court.

Joint Simplified Dissolution – The following forms, as approved by the Presiding Judge of the Domestic Relations Division, shall be filed to obtain a Joint Simplified Dissolution:

- Joint Petition for Simplified Dissolution;

- Affidavit in Support of Joint Petition for Simplified Dissolution;

- Agreement for Joint Simplified Dissolution; and

- Judgment for Joint Simplified Dissolution.

Pursuant to 750 ILCS 5/457, the Clerk of the Circuit Court of Cook County may provide to interested persons, upon request, the above forms and a brochure approved by the Presiding Judge of the Domestic Relations Division setting forth the procedures and requirements for obtaining a Joint Simplified Dissolution.

Service – Service of petitions, motions and other pleadings shall be in accordance with the law governing same.

Assignment – Original petitions shall be randomly assigned to either a team of judges or to an individual calendar judge. Each team shall be identified by letter, and the calendar of the preliminary judge shall bear the letter of the team. Each individual calendar shall be identified by number. Judicial teams and individual calendar judges shall each be responsible for all aspects of the cases assigned to them.

(i) Post-Judgment Cases – Post-judgment matters shall initially be assigned as follows:

- Any post-judgment motion or petition arising from a judgment entered in a case assigned to a judicial team shall be assigned to a judge on that team for post-decree.

- Any post-judgment motion or petition arising from a judgment entered in a case assigned to an individual calendar judge shall be assigned to that same individual calendar.

- Any post-judgment motion or petition that cannot be assigned to a post-judgment judge pursuant to paragraphs (a) and (b) above shall be randomly assigned by Order of the Presiding Judge of the Domestic Relations Division.

(ii) Dismissed Cases – Any domestic relations case between the same parties that is re-filed after a dismissal shall be assigned to the same judicial calendar to which the prior case was assigned immediately before its dismissal. The parties and/or their attorneys shall inform the Office of the Presiding Judge of the Domestic Relations Division that the cause is a re-filed matter.

https://www.cookcountycourt.org/division/domestic-relations-division

Filing a Case

The Clerk of the Circuit Court is responsible for accepting filings, which must be filed electronically. To learn more about electronic filing and to access a step-by-step guide, click here. For assistance with e-filing, you may contact the Clerk’s Office either by emailing eFilehelp@cookcountycourt.com or calling 312-603-5030.

Please note that certain groups and filings have been exempted from the electronic filing requirement. For more information and to learn whether you are exempted, click here.

For more information about the procedure for or costs associated with filing, please visit the Clerk of the Circuit Court’s website.

Assignment of Cases

Upon filing a new action in the Domestic Relations Division, your case will be randomly assigned to an individual calendar judge or a judicial team as prescribed in the Local Court Rules.

Judicial teams are comprised of multiple judges operating as one judicial unit. If your case is assigned to a judicial team, it shall be administered by that team from commencement through post decree.

The presiding judge has designated one member of each judicial team as a preliminary judge. All other judges on the team are trial judges. Preliminary judges hear pre-trial matters and are responsible for monitoring case progress. Trial judges hear contested trials, default or stipulated prove ups, post-decree matters, and any other matter assigned to them. When the preliminary judge certifies that a case is ready for trial or prove up, or determines that a pre-trial matter requires a hearing, the case may be assigned to one of the available team trial judges. Post decree matters are assigned to trial judges in accordance with Local Court Rules 13.2 and 13.3 and DR General Administrative Order 2017-D1: Consolidation of the Cook County Domestic Relations Division.

Individual calendar judges, conversely, operate independently to administer each aspect of your case from commencement through post decree. Individual calendar judges independently undertake each function of the case that the team calendars administer as a unit.

The link below will take you to the Cook County Domestic Relations for some of the most common forms used in the Domestic Relations Division.

RULE 13.3.1 Mandatory Disclosure

Pre-Judgment Disclosure –In all pre-judgment proceedings in which a party is seeking division of the marital estate, to establish, modify or enforce an order for maintenance, child support, or educational expenses pursuant to Section 513 of the Illinois Marriage and Dissolution of Marriage Act, support for a non-minor child with a disability pursuant to Section 513.5 of the Illinois Marriage and Dissolution of Marriage Act, disposition of property in a civil union, retroactive child support in parentage matters, or attorney’s fees and costs against the other party, each party shall serve a completed affidavit of incomes, expenses, debts, and assets (“Financial Affidavit”) upon the other party on forms approved by the court. The service of the “Financial Affidavit” shall be as follows:

The Petitioner shall serve the completed “Financial Affidavit” not later than thirty (30) days after service of the initial pleading and the Respondent shall serve the completed “Financial Affidavit” not later than thirty (30) days after the filing of the Responding party’s appearance.

Post-Judgment Disclosure – In all post-judgment proceedings in which a party is seeking to establish, modify or enforce an order of maintenance, child support, support for educational expenses pursuant to Section 513 of the Illinois Marriage and Dissolution of Marriage Act, support for a non-minor child with a disability pursuant to Section 513.5 of the Illinois Marriage and Dissolution of Marriage Act, or attorney’s fees or costs, the parties shall exchange a completed “Financial Affidavit” unless either party files a written objection with the court and shows good cause why such exchange should not be required. The service of the “Financial Affidavit” shall be as follows:

The Petitioner shall serve the completed “Financial Affidavit” not later than thirty (30) days after service of the initial pleading and the Respondent shall serve the completed “Financial Affidavit” not later than thirty (30) days after the filing of the responding party’s appearance.

Sanctions for Failure to Comply – Failure of a party to timely serve the “Financial Affidavit” shall subject the non-complying party to such sanctions as the court deems appropriate, including all sanctions available under Illinois Supreme Court Rule 219. Failure to comply shall not be sufficient cause for a responding party not in compliance to obtain a continuance of the hearing.

Certificate of Service – The completed “Financial Affidavit” should not be filed with the Clerk of the Circuit Court, unless ordered by the court. Each party shall file with the Clerk of the Circuit Court a Certificate of Service of the “Financial Affidavit” upon the other party.

Discovery –In pre-judgment and post-judgment proceedings, a party shall serve the other party with a completed “Financial Affidavit” before seeking discovery pursuant to Supreme Court Rule 201 unless otherwise ordered by the court for good cause shown.

Application to Joint Simplified Dissolution – Paragraph 13.3.1(a) shall not apply to Joint Simplified Dissolution Proceedings brought pursuant to 750 ILCS 5/451 et seq.

Time Limits – In the event a party posits an objection based on personal or subject matter jurisdiction, the time for service of the “Financial Affidavit” shall be tolled pending the court’s rulings. The court may extend or advance the time for service of the “Financial Affidavit,” or excuse service pursuant to good cause shown, or upon the written stipulation of the parties filed in the proceeding.

RULE 13.3.2 Proof of Income

In all proceedings where a Rule 13.3.1 Financial Affidavit is required, each party shall serve upon the other party, together with the Financial Affidavit, copies of the party’s last two (2) calendar years’ filed individual, partnership and corporate federal and state income tax returns, the most recent pay stub showing year-to-date earnings and deductions therefrom, or if the year-to-date information is not provided by the employer, the five (5) most recent pay stubs, and records of any year-to-date additional income and compensation (paid and deferred) not reflected in the pay stubs. Where a party has not yet filed a federal or state income tax return for the prior calendar year, the last filed year’s return shall be served upon the opposing parties as well as all W-2’s, 1099’s and K-1’s received necessary for preparation of the prior year’s return.

The Certificate of Service required to be filed by Rule 13.3.1(d) shall include a description of the proof of income documents served with the “Financial Affidavit.”

Mediation Program for Domestic Relations Cases

Mediation is a non-binding confidential process by which a neutral third person assists the parties in reaching a mutually acceptable agreement. Mediation is mandatory for (1) initial determinations of allocation of parental responsibilities; (2) modification of allocation of parental responsibilities; (3) relocation; and (4) non-parent (third party) visitation. Mediation is discretionary for all other issues, including financial and discovery disputes. The court may order parties to discretionary mediation, even if one or both parties object.

There are three (3) avenues in which parties may attend mediation:

- Child-Related Mediation with Family Court Services (FCS) – When issues are child-related, and the parties cannot agree on a mediator, FCS conducts the mediation. FCS is a department of the Office of the Chief Judge. All entered FCS orders shall be emailed to drd.family@cookcountyil.gov. The parties shall then receive a date and time for their mediation session from FCS. For questions about FCS mediation or scheduling, call (312) 603-1540. For more information, visit Family Court Services.

- Financial Mediation with a Court-Certified Mediator – For discretionary mediation of non-child related issues, the court may order parties to mediation with an attorney on the court-certified mediator list (attorneys only). Court-certified mediators are approved by the Presiding Judge of the Domestic Relations Division.

- Private Mediation by Agreement – Parties may agree to a private mediator that will cover both issues. The private mediator may come from the court-certified mediator list (attorneys and qualified mental health professionals), but any mediator willing to serve within a period of time that would not interfere with the court’s scheduling of the case for trial may mediate.

Court Order

Mediation at FCS is free, and available to parents only through a court’s order. The order must identify the issues that are to be discussed in mediation. Several of the issues identified in the order may include:

- Determinations of allocation of parental responsibilities.

- Modification of allocation of parental responsibilities.

- Creation of a parenting time schedule (this could include weekly, weekend, holiday, and vacation parenting time).

- Modification of a parenting time schedule.

- Relocation of the child(ren).

The order must include contact information for both parents, contact information for any attorney of record, Guardian ad Litem (GAL) or Attorney for the child(ren), and information regarding the minor child(ren). The order must also contain a court status date for FCS to report the outcome of mediation to the judge.

Once a judge enters an order for mediation, the order must be sent to FCS at DRD.family@cookcountyil.gov. Upon receipt of the order, FCS will assign a mediator to the case. Parents and attorneys are contacted through the information provided on the court order, and informed of mediation appointment dates and times.

Initial Duties of the Mediator

Parents are given two appointments to complete mediation. During the first appointment, the mediator must inform parents that the mediation process is confidential and privileged, and must also explain the limitations of that confidentiality and privilege. Each parent is then screened separately for any impediments to the mediation process, to ensure that mediation is appropriate and safe for all participants. The information shared during the screening is kept confidential from anyone else, including the other parent. The mediator must define and describe the process of mediation to the participants, including the procedure that will follow if an impediment to mediation becomes apparent after the mediation process has commenced. If a mediator determines that an impediment to mediation exists, they shall indicate such on a Mediation Status Report by marking the case “inappropriate for mediation” and submit it to the court by the status date scheduled on the court order. The particular impediment or reason for marking the case inappropriate shall not be disclosed except to inform law enforcement or child protective services if necessary. Once screening is complete and it is determined that mediation can occur, the mediator will inform participants how mediation will proceed.

A. Non-Advocate Neutral

The mediator serves as a facilitator of the mediation process, to assist parents in communicating their ideas and proposals in an effort to reach an agreement. Mediators must advise parents that they do not represent nor advocate for either parent, nor do they provide therapy or counseling to either party.

B. Mandatory Reporting

FCS mediators are mandated to report any suspicions of abuse or neglect of any minor child(ren) to the Department of Children and Family Services. Mediators must explain the mandated reporting requirements of the Abused and Neglected Child Reporting Act, 325 ILCS 5/1 et seq. as well as the limitations of the rules of privilege and confidentiality in the mediation process.

C. Legal Advice and Attorney Access

Mediators will not provide any legal advice. Mediators may, however, provide information to parents on how to access legal representation and advice through available legal resources for self-represented litigants and Pro Bono legal services. Mediators must advise parents that they have a right to consult with an attorney at any time during the mediation process.

D. Conflicts of Interest

FCS mediators must disclose the nature and extent of any existing relationships with the parties or their attorneys and any personal, financial, or other interests that could result in bias or a conflict of interest on the part of the mediator. The mediator who discloses a conflict–real or perceived–will be replaced by a different FCS mediator who is free of any possible conflict of interest.

E. Caucusing or Shuttle Mediation

The mediator must inform parents that it may become necessary to speak separately with one or both parents, or either party’s attorney, without the other parent or the other parent’s attorney being present. Mediators may also decide to “shuttle” the mediation by conducting mediation with no direct communication between parents. Shuttle mediation may be employed to protect the integrity of the mediation process or to protect the physical and emotional safety of all participants.

Child Interviews

Parents are given (two) 2.5-hour appointments to complete mediation. As part of the second mediation appointment, mediators may interview children between the ages of 5-17. FCS uses a child-focused mediation model through which parents are empowered to focus on future co-parenting and the impact of their decision-making on their children. Children are interviewed separately from their parents, and their interviews are also confidential and privileged. Children do not take part in the decision-making process. They are interviewed only to ascertain their understanding of and adjustment to their family’s new reality, in the hope that parents will consider their needs when making decisions regarding their future.

Some benefits of interviewing children as part of the mediation process include:

- Mediator can provide feedback to the parents about the child(ren)’s perceived needs – parents may be better able to hear such information from an objective, impartial third party. The feedback may also help parents to focus more on the best interests of their child(ren).

- Reality check – parents may be relieved to know that the child(ren) are not afraid and are adjusting well to their new reality; or, parents may be surprised by the child(ren)’s difficulty in adjusting.

- Child interviews can validate the child(ren)’s feelings; the mediator can acknowledge and normalize a child’s feelings and experience.

- Stimulate movement and solidify an agreement – upon receiving feedback about the child(ren)’s adjustment, parents may be able to move beyond impasse to create a durable, child-centered agreement.

- Helps mediator determine if referrals would be helpful, and which referrals would be most appropriate. (e.g., counseling, school conference, child support groups)

A mediator may decide that a child interview is not recommended if a child is so developmentally disabled that an interview may be detrimental or impossible.

Completion of the Mediation Process

Once mediation is complete, the mediator must memorialize any agreements made in writing and provide a written copy to each parent. Written copies must also be submitted to any attorney of record (including any GAL or Attorney for the child(ren)), and to the court before the court status date. The mediator must also submit to the court, parents, and any attorney of record before the court status date a copy of the Mediation Status Report which shall indicate when mediation occurred, who participated, if children were interviewed, and the outcome (Full Agreement, Partial Agreement, or No Agreement; if mediation was Not Completed, Did Not Occur, or if the case is Inappropriate for Mediation). Copies of mediation agreements will not be provided once the court status date has passed.

Please note that mediation agreements are voluntary and non-binding. A mediated agreement must be approved and entered by a judge to become enforceable and binding upon parents.

For more information and a list of FAQ regarding Mediation please visit the Family Court Services website at:

https://www.cookcountycourt.org/department/family-court-services/mediation

What is a Guardian ad Litem?

A Guardian ad Litem (also known as a “GAL”) is an attorney appointed to investigate the best interest of the child(ren) and make recommendations to the court. The Guardian ad Litem is required to investigate the facts of the case, interview the child(ren) and the parties, and submit a written recommendation to the court. The GAL may be called as a witness at trial for purposes of cross-examination regarding the guardian ad litem’s report or recommendations. GALs may be present for all court proceedings, issue subpoenas, and file pleadings related to procedural matters. GALs are often referred to as the “eyes and the ears of the court.”

For more information on this topic, please click on the link below.

What is a Parenting Coordinator?

Pursuant to Illinois Supreme Court Rule 909 and Local Court Rule 13.10, the court may appoint a parenting coordinator when it finds that the co-parents failed to adequately cooperate and communicate with regard to issues involving their children, or have been unable to implement a parenting plan or parenting schedule; mediation has not been successful or is inappropriate; or the appointment of a parenting coordinator is in the best interests of the children.

A parenting coordinator is an attorney or mental health professional appointed to help resolve conflicts between co-parents regarding an existing parenting plan. The parenting coordinator educates, mediates, and makes recommendations to the court and to the parents to reduce conflict and unnecessary stress for the children. The parenting coordinator will work with both parents to attempt to resolve conflicts and, if necessary, will recommend an appropriate resolution to the parents. They will maintain communication between the parties and recommend outside resources as necessary.

The Court may appoint a parenting coordinator when it finds the following:

- The parties failed to adequately cooperate and communicate with regard to issues involving their children, or have been unable to implement a parenting plan or parenting schedule;

- Mediation has not been successful or has been determined by the judge to be inappropriate; or

- The appointment of a parenting coordinator is in the best interests of the child or children involved in the proceedings.

Child Support

Common Terms and Acronyms

DCSS: Division of Child Support Services

CP: Custodial Parent, the adult that has legal custody of the child(ren)

NCP: Non-Custodial Parent, the parent obligated to pay child support

SDU: State Disbursement Unit- the organization that processes child support payments

Paternity: The legal relationship between a father and child

Obligor: The person who owes support (NCP/Non-Custodial Parent)

Obligee: The person who receives child support (CP/Custodial Parent)

TANF: Temporary Assistance for Needy Families

Pass-through: Money which may be paid to CPs who are receiving TANF

VAP: Voluntary Acknowledgement of Paternity—a form, that when signed by both the mother and the alleged biological father, establishes paternity. The biological father’s name is allowed on the child’s birth certificate

Administrative Appeal: a written request made by the custodial or non-custodial parent for an administrative hearing on an action taken by DCSS. These appeals are heard separate from HFS by the Bureau of Administrative Hearings

Every state has guidelines for establishing or modifying child-support arrangements. To file for Child Support, please click on the link below.

https://hfs.illinois.gov/childsupport/parents/applications.html

Who pays child support?

In a proceeding for dissolution of marriage, legal separation, maintenance or child support, the court may order either or both parents owing a duty of support to a child, born to or adopted by the parents, to pay an amount reasonable and necessary for support of the child, without regard to marital misconduct.

The supreme court shall establish guidelines for determining the amount of child support. The amount resulting from the application of these guidelines is the amount of child support ordered unless a written finding is made, based on criteria approved by the supreme court, that application of the guidelines would be inappropriate or unjust in a particular case.

In Illinois, the method used to set the amount of child support is income shares based on both parents’ net income and the number of children included in the child support order using the Illinois child support guidelines. The Illinois mandatory child support guidelines require both parents’ financial information to calculate the child support obligation. Either parent may be ordered to provide child support and/or medical coverage. However, only one parent will be ordered to pay child support to the other parent.

The incomes of both parents are combined and the number of children the parents share are identified. The Basic Support Obligation is calculated using an independent, statistically valid table of expenditures, and the amount a family of that size and income would spend on the child or children. This support amount will be payable on a monthly, semi-monthly, bi-weekly or weekly basis, depending on the NCP’s/obligor’s pay schedule.

To calculate a Child Support payment please click on the link below.

https://hfs.illinois.gov/childsupport/parents/childsupportestimator.html

There are several methods of paying child support:

Income Withholding

The best method for making payments is through income withholding. Your child support payments can be withheld directly from your paycheck and sent by your employer to pay your child support. This ensures your payments are made on time.

Automatic Withdrawal Payments (Deduct from Your Bank Account)

Online automatic withdrawal payments can be made through ExpertPay℠. Register for ExpertPay℠. Payments can also be made by telephone at 800.403.0879. Payments made through ExpertPay℠ are received at the Illinois State Disbursement Unit (SDU) in 5 business days. There is a one-time registration fee of $2.50. There are no transaction fees.

Credit/Debit Card Payments

Online credit/debit card or PayPal payments can be made through ExpertPay℠. Register for ExpertPay℠. Payments also can be made by telephone at 866.645.6347. Payments made through ExpertPay℠ are received at the Illinois State Disbursement Unit in 4 business days. Fees are 2.95% of the payment amount with a maximum fee amount of $60.

Online credit/debit card payments can also be made through MoneyGram®. Click here for online payments. Payments also can be made by telephone at 800.926.9400. Payments made through MoneyGram® are received at the Illinois State Disbursement Unit in 2 business days.

Mail Payment

Make checks and money orders payable to Illinois State Disbursement Unit (SDU)

Mail payments to:

Illinois State Disbursement Unit (SDU)

P.O. Box 5400

Carol Stream, IL 60197-5400

Properly identify payments with the following information for each payment on each separate order:

- Full Name

- Social Security Number

- Payment amount for each case/docket number if there is more than one order

- Case/docket number

Special Enforcement Payments

Mail payments to:

Illinois State Disbursement Unit (SDU)

Attn: (Driver’s License, Passport, Lien, etc.)

P.O. Box 4614

Carol Stream, IL 60197-4614

Walk-In Payment

MoneyGram® locations throughout the state

Walmart and CVS Pharmacy® are among the retailers providing MoneyGram® services. To locate a MoneyGram® location near you, click here. Look for locations offering “Pay a Bill” services. Walmart also accepts pin-based debit card payments. Click here to see for more information on “how to make walk-in MoneyGram® payments.” Payments made through MoneyGram® are received at the Illinois State Disbursement Unit in 2 business days. MoneyGram® charges a $3.99 fee per walk-in payment.

Regional Office

All Child Support Services Regional Offices accept personal checks and money orders. Cash will NOT be accepted.

Request a Modification

Changing a Child Support Payment Amount

At any time, either parent or the child’s legal guardian can ask for a change (called a “modification”) to increase or decrease the amount of court-ordered child support. You can petition the court yourself or utilize Child Support Services (CSS) to review your case at no charge. You must have a case with CSS for our assistance in completing a modification. A case for you can be opened at any time. Guidelines require CSS cases be reviewed every three years. As a rule, a 20% increase or decrease is required for a change.

You should request a modification if:

- You are laid off or fired from your job,

- You get a new or an additional job,

- Your income increases or decreases,

- A change in custody or visitation,

- A change in the size of your family,

- You become disabled,

- You go to jail or prison,

- You are deployed to active service.

You will need to provide proof of these changes.

How do I handle my ex’s failure to make timely child-support payments?

One potential problem with respect to finances involves late payment or non-payment of child support. While it is tempting for parents to consider withholding visitation rights in this circumstance, it is never a good idea. Experts agree that withholding visitation does children more harm than good, and it risks getting yourself into legal trouble as well. Instead, you should attempt to resolve the matter with the other parent directly. If you are unsuccessful, consult an attorney to help enforce correct and timely child-support payments. Be aware that you still have a responsibility to your children as you are dealing with stressful financial situations. Realize that your children will be aware of your angry feelings, even if you do not openly bad-mouth the other parent. Children of all ages know how parents feel toward one another, regardless of what is said.

The Illinois Division of Child Support Services continues to track balances and will add a delinquent amount to any future income withholding until the past due support is caught up. DCSS also will use special collections options to obtain child support. These options include: federal and state tax offsets, comptroller offsets, bank liens, property liens, lawsuit/settlement liens, driver’s license suspension, hunting/fishing license suspension, professional license suspension, passport denial/revocation, offset of lottery and/or casino winnings, reporting to credit monitoring agencies, and submittal to the delinquent parent website.

It is never recommended child support and parenting time be contingent upon one another. Parents are not permitted to make decisions regarding withholding parenting time it has been previously ordered by the court.

Understanding of the Financial Responsibilities of Co-Parents to Your Children

You will be better off financially, however, if you can keep your emotions from influencing your financial decisions. At the very least, you will be able to make better financial decisions for yourself and your children. The following information will help familiarize you with some issues that accompany the division of finances during a divorce. It is not intended as a complete guide or as a substitute for legal or financial advice.

Do the parents have to carry health insurance for the child(ren)?

DCSS may obtain, as part of the child support order, health insurance coverage for the child(ren). When health insurance is available through a parent’s employer or trade union, DCSS enters an order requiring the child(ren) to be enrolled in that health insurance plan. If health insurance coverage is not available through a parent’s employer or trade union, the parent may be ordered to pay the insurance premium, add the child(ren) to any other available group plan, obtain private health insurance coverage, or be ordered to pay a monetary amount to cover health care needs.

The Department of Healthcare and Family Services has a health insurance program, called All Kids, offered to Illinois’ children at a reduced rate or at no cost to the parent. This does not affect the parent’s obligation to provide health coverage. For more information on this program, call the All Kids Hotline at 1-866-ALL-KIDS (1-866-255-5437).

How do we begin to separate financially?

In a relationship, one of you usually takes primary responsibility for managing finances and keeping financial records. If you are not well informed, this is your opportunity to be involved in your financial affairs. Many people feel anxious when considering finances, but realize that it is mostly about gathering information and making decisions. The sooner you begin participating in your financial decisions, the sooner you will have the peace of mind that you are taking the necessary steps. Remember, knowledge provides you with a more realistic view of your financial situation as decisions are made. Even in ‘friendly’ break-ups, you should not rely on fate to determine what to do about shared property or joint accounts. Be aware that accounts shared jointly can be accessed by both parties. In addition, each person authorized to use a credit card can run up an extensive bill. Try to be objective about your situation and use some common sense. Your immediate goal is to reduce your financial ties to the person you aren’t in a relationship anymore; your ultimate goal is to create two financially separate households. While it is usually impossible to sever all financial ties, you can greatly reduce the areas where you are at risk. Seek the advice of an accountant or financial planner to help you learn about various financial issues.

How do we divide property?

In general, each person is entitled to an equitable or fair distribution of the property. Property includes automobiles, homes, and furniture, in addition to possessions such as cash-value insurance policies, pension funds, savings accounts, etc. As you negotiate the division of property, think about your needs and the needs of your children, as well as the financial consequences of your decisions. Frequently, material items that you valued during your marriage may have little value once you are divorced. It is not uncommon for people to spend a great deal of time arguing over material possessions. It can also be a ready-made battleground for continuing past marital arguments. Choose your battles carefully, and realize that you will be making some concessions when it comes to material possessions. Ultimately, you and your children will be better off if you can minimize the conflict around dividing property and material possessions.

In Illinois, the primary statute governing the disposition of property outlines the rules for determining what is considered marital property and how it should be divided. Illinois follows an equitable division approach, meaning marital property is divided in a fair way, not necessarily 50/50.

Marital Property:

Generally, marital property is defined as anything acquired by either spouse during the marriage and before the date of the divorce. This includes assets like the marital home, retirement accounts, vehicles, and other property acquired during the marriage.

Equitable Division:

Illinois courts aim for an equitable division of marital assets, meaning a fair and just division, even if it’s not a 50/50 split. The court considers several factors when determining a fair division.

- The contributions of each party to the marriage, both financial and non-financial.

- The value of the property at the time of the divorce.

- The needs of each party.

- The economic circumstances of each party.

- The duration of the marriage.

- The age and health of each party.

- Whether any party has been awarded maintenance (alimony).

- Any other factors relevant to the case.

Non-Marital Property:

Non-marital property is property owned by either spouse before the marriage or acquired during the marriage by gift or inheritance. This property is typically assigned to the individual spouse.

Statute for disposition of property:

How should we deal with debt?

In the case of divorce, you divide not only property, but debt as well. In general, you both are responsible for paying any debts acquired during the marriage. Managing debt issues carefully during the divorce process may lead to less conflict and a more stable environment for you and your children. You should act promptly to close all joint credit cards or other lines of joint credit. Be sure to establish credit in your own name before doing so. Often, you can open an individual account when you close a joint one. A credit card can help you through some short-term emergencies during the divorce transition. However, avoid saying, ”charge it,” rather than making necessary cuts in spending after divorce. Make a list of the outstanding balances on any credit cards or other debts. Get the address of a credit bureau from the phone book and request a credit report to make sure you are aware of all open accounts. Once the divorce is filed, debts should be divided between you and your spouse, and each person should be responsible for payment of his/her debt.

Remember that even after the divorce is final, creditors may attempt to collect on debts from both partners. A divorce decree will be honored by the courts, but it may not matter to collectors—their goal is to collect the money. It is not always possible to remove your name from a joint debt until the debt has been paid in full. Finding out what your options are and remaining aware of your financial situation can help ease the financial separation that comes with the divorce process. This process will take time, but the payoff is a brighter financial future.

In your property settlement agreement or decree of dissolution, annulment or legal separation, the court may assign responsibility for certain community debts to one spouse or the other. Please be aware that a court order that does this is binding on the spouses only and does not necessarily relieve either of you from your responsibility for these community debts. These debts are matters of contract between both of you and your creditors (such as banks, credit unions, credit card issuers, finance companies, utility companies, medical providers and retailers).

Since your creditors are not parties to this court case, they are not bound by court orders or any agreements you and your spouse reach in this case. On request, the court may impose a lien against the separate property of a spouse to secure payment of debts that the court orders that spouse to pay.

You may want to contact your creditors to discuss your debts as well as the possible effects of your court case on your debts. To assist you in identifying your creditors, you may obtain a copy of your spouse’s credit report by making a written request to the court for an order requiring a credit reporting agency to release the report to you. Within thirty days after receipt of a request from a spouse who is party to a dissolution of marriage or legal separation action, which includes the court and case number of the action, creditors are required by law to provide information as to the balance and account status of any debts for which the requesting spouse may be liable to the creditor.

In summary, be aware that finances are a big consideration when establishing two households. Parents who can discuss financial issues calmly and fairly will ultimately save money. Remember to get professional advice where appropriate. In addition, realize that your children will fare much better and feel more secure when they see you handling adult matters (such as financial issues) with fairness, dignity, and respect.

Court Resources

Family Court Services

https://www.cookcountycourt.org/department/family-court-services

Family Resource Connections

https://hfs.illinois.gov/childsupport/parents/family-resource-connections.html

https://www.illinoislegalaid.org

For more than 20 years, Illinois Legal Aid Online (ILAO) has opened opportunities to justice so that people can resolve their problems, especially those with the least access to the legal system. Through innovation and partnership, we make the law actionable and accessible.

https://hfs.illinois.gov/about.html

Department of Healthcare and Family Services

The Illinois Department of Healthcare and Family Services (HFS) is responsible for providing healthcare coverage for adults and children who qualify for Medicaid, and for providing Child Support Services to help ensure that Illinois children receive financial support from both parents. The agency is organized into two major divisions, Medical Programs and Child Support Services. In addition, the Office of Inspector General is maintained within the agency, but functions as a separate, independent entity reporting directly to the governor’s office. (HFS was formerly the Illinois Department of Public Aid)

https://hfs.illinois.gov/childsupport/parents.html

For Child Support Questions

To print out a copy of this chapter, please click below.